Adding a family member

Family members whose lives are supported by the insured individual's income can receive health insurance benefits as "dependents." The mere fact of being a family member does not qualify someone to be a dependent for health insurance purposes. There are certain legal, etc., requirements that must be fulfilled.

Dependents for health insurance purposes are under criteria that are completely different from dependents in relation to the company's dependent allowance or under tax law.

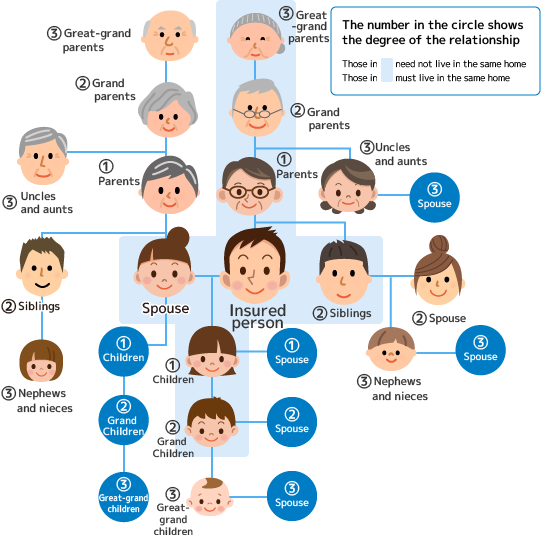

| A person who may live with or separately from the insured person |

|

|---|---|

| A person whose condition is to live with the insured person |

|

Standards for Certification of Dependents

Each of the following conditions must be met for a person to be certified as the insured individual's dependent. The Health Insurance Society reviews the following items comprehensively and carefully then decides whether the person qualifies as a dependent.

Condition of income

- The person’s annual must be less than 1.3million yen(1.8million yen in the case of those aged 60 or older or a disabled person)

- Less than half the income of the insured person

The tax reform for fiscal year 2025 revised the requirements for the dependent deduction for this age group and created a special deduction for specific relatives.

Effective October 1, 2025, the certification criteria for dependants aged 19 to 23 (excluding the spouse of the insured person) under health insurance will be changed.

-

The annual income requirements: Annual income of less than 1.5 million yen

*This applies to those whose dependent certification date is October 1, 2025 or later.*As in the past, a certified person's income will be estimated for the coming year, taking into account past, current or future income. -

Age requirement: 19 years old or older, but under 23 years old

*The age is determined based on the age as of December 31st of the year in which the dependent certification date falls.*There is no requirement that the dependents be students.

- The annual income requirement for year N-1 (the year of turning 18) is less than 1.3 million yen.

- For the period from year N to year N+3 (from the year in which the individual turns 19 to the year in which they turn 22), the annual income requirement is less than 1.5 million yen.

- The annual income requirement from year N+4 (the year of turning 23) until the individual turns age 60 is less than 1.3 million yen.

1.5 million yen for individuals aged 19 to 23 on December 31 of that year (excluding the spouse of the insured person)

- For the same individual, even if their annual income temporarily exceeds the income limit, they may remain eligible as a dependent for up to two consecutive years under normal circumstances.

- If the income exceeds the income limit for three consecutive years, procedures to remove their dependent status will be required.

- As a general rule, freelancers and self-employed individuals are not eligible for this program.

The person’s income must be less than 1.3million yen (1.8million yen in the case of those aged 60 or older or a disabled person)and less than half the income of the insured person

Other

- The insured individual is providing that person with support.

The insured individual must be providing most of the person's living expenses. Even if the income criteria are met, the person will not be considered to be a dependent if he or she is economically independent. - The insured individual must have the ability to support the person.

The insured individual must have the ability to provide economic support to provide continuously for the family. Even if other requirements are met, the person will not be added as a dependent if it is judged that the insured individual does not have the ability to provide support.

- The people with a higher priority obligation to support the person ("parents," etc., in the case of siblings and grandparents) do not have the ability to do so.

- There are unavoidable reasons that the insured individual must support the family member.

- As a rule, children become dependents of the parent with the higher income.

- If the incomes are at the same level, the child will become the dependent of the parent who is the main person supporting the household, as they have notified.

Individuals who are age 16 or older and under age 60 are at an age that allows them to work, and in many cases they can live independently without the economic support of the insured individual. Accordingly, to become a dependent, documents must be submitted certifying that the person is unable to work, and notification must be submitted indicating that the insured individual must provide most of the person's living expenses.

As a rule, while the person is receiving unemployment benefits, it is unlikely that he or she "is living mainly on the income of the insured individual," so he or she will not be recognized as a dependent. However, these individuals may qualify as a dependent if the amount of unemployment benefits is small*. In addition, individuals who are waiting for benefits or who are in a benefit restriction period can qualify as dependents because they have no income.

However, for individuals aged 19 to 23 on December 31 of that year (excluding the spouse of the insured person), the daily basic allowance will be less than 4,167 yen.

If you want to add a family member as a dependent, enter the required information in the following documents, attach the required documents, and submit the application to the Health Insurance Society within five days, via the human resources department of your company.

The day of dependent certification

Even after the Dependent Change Notification has been submitted, the person does not qualify as a dependent until the Health Insurance Society certifies him or her as a dependent. Once the person has been certified as a dependent, he or she can receive the same insurance benefits as the insured individual for treatment of injuries and illness, beginning on the day of certification.

The day of dependent certification

| If a child has been born | Birthdate |

|---|---|

| If the individual has dependents at the time of hiring |

The day on which the insured individual acquired eligibility

|

| When there is a new dependent |

The day on which the reason arose

|

Confirmation of dependent qualifications (verification)

Confirmation of dependent qualifications is conducted with a set deadline, and recertification will be conducted. If you are unable to submit the required documents at the time of the investigation, the eligibility may be revoked, so it is necessary to prepare proof of remittances and other documents so that they can be submitted at any time.

Punitive Measures for Fraudulent Applications

If it is discovered that the insured individual has obtained certification under false pretenses of a family member who is not actually being supported, the dependent's eligibility will be retroactively revoked and all medical expenses and other payments made during the relevant period must be returned.