When you incur high medical care costs

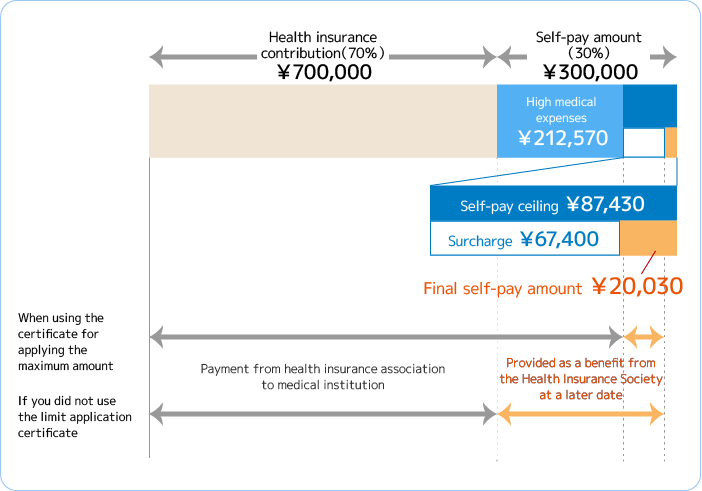

When the self-pay amount of medical expenses exceeds a certain amount, the health insurance association automatically calculates it based on the medical treatment statement (receipt) sent from the medical institution, and at a later date, "high medical expenses" and the total amount of "additional benefit expenses" will be paid.

(Expenses not covered by insurance, such as bed charges, and meals when hospitalized are not covered)

High medical expenses

If you are hospitalized due to illness or injury, a large amount of medical expenses may be incurred. If the self-pay amount exceeds a certain amount, the excess amount will be provided by the health insurance association as "high medical expenses".

High medical expenses are usually paid once at a medical institution, etc., and then refunded at a later date. It is not necessary for insured persons and dependents to submit applications.

In addition, the Health Insurance Society will pay the amount after deducting ¥20,000 from the self-pay limit at a later date (less than ¥1,000 will not be paid, rounded down to the nearest ¥100). This is called "Partial contribution reduction (family medical treatment surcharge)." Payment will be calculated automatically based on the "medical treatment statement" sent from the medical institution to the health insurance association, but the payment will be made approximately 3 to 4 months after the medical treatment month.

* There is also a high-priced medical treatment / high-value nursing care complex system that refunds the total amount of self-paid medical insurance and long-term care insurance if the total amount exceeds a certain amount.

Payment and additional benefits

| Payment |

When the self-pay amount of medical expenses per month exceeds the limit, the amount exceeded

(Low-income people, 70-74 years old have different limits) |

|---|---|

| Health insurance association additional benefits |

Partial refund, family medical treatment surcharge :Pay the amount of ¥20,000 deducted from the self-pay amount (less than ¥1,000 will not be paid, rounded down to the nearest ¥100) * Excludes high-cost medical treatment, standard medical expenses for hospital meals, and standard medical expenses for daily living at hospitals. |

(maximum amount for one month)

| Income Category | Up to 3 times | From the 4th time |

|---|---|---|

| Standard monthly remuneration is ¥830,000 or more |

¥252,600 + (medical care costs ? ¥842,000) × 1% |

¥141,100 |

| Standard monthly remuneration is between ¥530,000 and ¥790,000 |

¥167,400 + (medical care costs ? ¥558,000) × 1% |

¥93,000 |

| Standard monthly remuneration is between ¥280,000 and ¥500,000 |

¥80,100 + (medical care costs ? ¥267,000) × 1% |

¥44,000 |

| Standard monthly remuneration is ¥260,000 or less |

¥57,600 | ¥44,000 |

| Low income※ | ¥35,400 | ¥24,600 |

| Income Category | outpatient (Per-person) |

outpatient + inpatient (Per household) |

|||

|---|---|---|---|---|---|

| Active income earners | level similar to active workersⅢ Standard monthly remuneration is ¥830,000 or more |

Active income earners level similar to active workersⅢ(Standard monthly remuneration is ¥830,000 or more) |

¥252,000 + (medical care costs - ¥842,000 ) ×1% [¥140,100] |

||

| level similar to active workersⅡ Standard monthly remuneration is ¥530,000- ¥790,000 |

Active income earners level similar to active workersⅡ(Standard monthly remuneration is ¥530,000- ¥790,000) |

¥167,400 + (medical care costs - ¥558,000 ) ×1% [¥93,000] |

|||

| level similar to active workersⅠ Standard monthly remuneration is ¥280,000 -¥500,000 |

Active income earners level similar to active workersⅠ(Standard monthly remuneration is ¥280,000 -¥500,000) |

¥80,100 + (medical care costs - ¥267,000) ×1% [¥44,000] |

|||

| General | Standard monthly remuneration is ¥260,000 or less | General (Standard monthly remuneration is ¥260,000 or less) |

¥18,000 (Annual limit ¥144,000) |

¥57,600 [¥44,400] | |

| Low income (Resident tax exemption) |

Ⅱ | Low income (Resident tax exemption)Ⅱ |

¥8,000 | ¥8,000 | ¥24,600 |

| Ⅰ(Pension income of ¥806,700 or less) | Low income (Resident tax exemption)Ⅰ (Pension income of ¥806,700 or less) |

¥8,000 | ¥15,000 | ||

If you have been a member of our Health Insurance Society throughout the calculation period, the payment will be made automatically and no application is required.

If you changed insurers during the calculation period, you will need to apply for the payment, so please contact the Health Insurance Society.

Those who receive infants and children medical expenses subsidy system, etc.

Regarding medical expenses (high-cost medical treatment expenses and family medical treatment surcharges) during compulsory education, local governments (prefectures and municipalities) have also implemented a "medical expense subsidy system" to subsidize medical expenses.

In order to prevent double payment of benefits with the subsidy of the local government, the Health Insurance Society does not automatically provide high-cost medical treatment expenses and family medical treatment surcharges for persons during the compulsory education period.

If the medical expenses become high and four months after the medical treatment month and there is no benefit from the local government or the health insurance association, please contact the health insurance association.

Limit application certificate.

If the self-pay amount exceeds the limit, if you apply to the health insurance association in advance and receive a certificate, you can show it to a medical institution and pay at the counter up to the self-pay limit.

If you use your Individual Number Card (My Number Card) as your health insurance card, you will be exempt from paying any out-of-pocket expenses that exceed the maximum amount under the High-Cost Medical Expenses System without undertaking any prior procedures.

There is no need to apply for an Eligibility Certificate for Ceiling-Amount Application in advance.

For more information, please see here.

In addition, if the medical institution cannot confirm your eligibility using your Individual Number Card, you may not be able to receive an exemption.

- Health insurance limit application certificate application form

EXCEL

However, if you fall into the low-income earner category, you are required to apply in advance for the Eligibility Certificate for Ceiling-Amount Application and Reduction of the Standard Amount of Patient Liability, even when using your Myna Health Insurance Card.

If you fall into this category, please contact your health insurance society.

How to calculate high medical expenses.

How to calculate high medical expenses.

- Calculation for each consultation month (1st to last day of the month)

- Calculated for each examinee

- Calculation for each medical institution (Inpatient / outpatient / dentistry is calculated separately. For old general hospital, each department is calculated)

In case of household total

If there are two or more self-payments of ¥21,000 or more per month in the same household, if the sum of those amounts exceeds the self-pay limit, the amount exceeding that amount will be paid as "total high medical treatment expenses".

When high-cost medical expenses apply for the fourth time or more (many apply)

If the same household receives high-cost medical treatment three or more times in the last 12 months, the self-pay limit will be as follows after the fourth time.

| Standard monthly fee | Self-pay ceiling |

|---|---|

| ¥830,000 or more | ¥140,100 |

| More than ¥530,000 and less than ¥790,000 |

¥93,000 |

| More than ¥280,000 and less than ¥500,000 |

¥44,400 |

| ¥260,000 or less | ¥44,400 |

| Low income (Exemption from residence tax) | ¥24,600 |

Special cases of specific diseases.

Long-term patients with "hemophilia", "acquired immunodeficiency syndrome with antiviral agents", and "chronic renal failure requiring artificial dialysis" will be admitted to a medical institution when certified for a specific disease. The payment is ¥10,000 per month. However, if a patient who needs artificial dialysis has a standard monthly salary of ¥530,000 or more, the self-pay will be ¥20,000 per month. (Same for dependents)

Those who receive treatment for a specific illness will receive the "Specific illness medical treatment medical treatment certificate" after submitting it to the Health Insurance Society with the proof of the doctor in the "Specific medical treatment medical treatment certificate application".

The "specific medical treatment medical treatment certificate" issued by the Health Insurance Society will be submitted together with the Myna Health Insurance Card or Health Insurance Eligibility Certificate to the medical institution counter.

* Since the amount received by the Health Insurance Society until the end of the month will be applied this month, if you are to be treated for a specific disease, please submit the application form immediately.

- Application form for specific medical treatment certificate

EXCEL