Nursing Care Insurance

As Japanese society has aged in recent years, the need for nursing care has increased, while the shift to nuclear families, the aging of family members who provide nursing care, and leaving employment to provide nursing care, etc., have become social issues. In such circumstances, the "Nursing Care Insurance System" was established to reduce the burden on families and provide mutual support for the nursing care of the elderly by society as a whole.

All individuals are insured when they reach age 40, and are required to pay nursing care insurance premiums.

Insured individuals to whom nursing care insurance applies

-

Type-1 insured individualsIndividuals age 65 and older

-

Type-2 insured individualsIndividuals age 40 and over, under age 65

Exclusions

- Individuals working outside Japan who have submitted a move-out notice to the town or city in which they were living

- Foreign citizens whose residence status or anticipated stay is short-term (three months or less)

- Individuals with physical disabilities who have been issued a handbook and who reside in a treatment facility for the physically disabled

Nursing Care Insurance Premiums and Standard Compensation

Nursing care insurance is a mandatory social insurance. All insured individuals age 40 or older who belong to the Society are enrolled in nursing care insurance (Type-2 insured individuals), and must pay nursing care insurance premiums.

Nursing care insurance premiums for insured individuals age 40 to 64 are collected by the Society at the same time as health insurance premiums, and the nursing care insurance premiums for individuals age 65 or older (Type-1 insured individuals) are collected by the local municipality. (As a rule, they are withheld from annual pensions.)

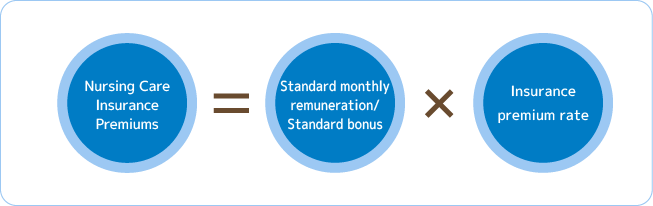

Insurance Premium Calculation Method

Nursing care insurance premiums are calculated by multiplying the "standard monthly compensation and standard bonus amounts" by the "insurance premium rate."

The insurance premium rate is calculated by dividing the total amount of nursing care benefit expense payments allocated to the Society each fiscal year by the Health Insurance Claims Review & Reimbursement Services by the total amount of the standard monthly compensation and the standard bonus amount of all insured individuals age 40 to 64, with half being paid by the business operator.

Nursing care insurance benefit services

There are two categories of service available through nursing care insurance: "preventive benefits" and "nursing care benefits."

"Preventive benefits" are nursing care insurance benefits paid to individuals recognized as requiring help, and "nursing care benefits" are those paid to individuals recognized as requiring nursing care. The degree of need for help or nursing care is reviewed and assessed in certifying the need for help or nursing care.

-

Individuals eligible for preventive benefitsRequiring help 1/Requiring help 2

-

Individuals eligible for nursing care benefitsLong-term care requirement levels

1 to 5

Nursing care insurance benefits are paid in kind (nursing care services). The maximum monthly payment standards are determined according to the category of need for help or nursing care.

Out-of-pocket amount

If an individual has received nursing care services, the user pays 10% of the cost (or 20% in the case of individuals with income of a certain level), but if the out-of-pocket amount exceeds the set maximum, the excess amount will be refunded. This is called the "High-cost Nursing Care Services System," and the amount is calculated in individual units or in household units including the individual's spouse, etc. However, this does not apply for portions not covered by insurance.

* For questions regarding nursing care services or application for certification of the need for nursing care, please contact the relevant office of your local municipality directly.